You cannot turn on the television or radio or read any newspaper publication these days without hearing about the financial crisis and recession that the United States currently faces. The S&P 500, generally considered the benchmark for U.S. equities, underwent an annual drop in 2008 unprecedented since 1937.1 In the current economy, we must deal with issues such as the highest contraction rates in manufacturing and the lowest consumer confidence levels experienced in 26 years.2 U.S. companies cut 250,000 private sector jobs in November 2008, according to the ADP National Employment Report,3 and profits for companies in the S&P 500 were down 7.4 percent in the third quarter of 2008.4 As you well know, the list goes on and on.

As companies across the country are evaluating and implementing various budgetary plans and cuts in order to stay afloat during this crisis, corporate legal departments cannot avoid the crunch. Corporations have always viewed their legal departments as cost centers, and in light of these tough economic times, 75 percent of corporations have actually cut their legal department budgets for 2009.5 At the same time, 71 percent of the NLJ 250 law firms have raised their hourly billable rates for 2009.6 Therefore, corporate legal departments must demonstrate value to the leadership of their companies, and inhouse counsel must show that they are actively managing costs. Maintaining the status quo simply will not work anymore, and the argument that “legal departments are different” just will not fly. Corporate legal departments absolutely must reduce costs allocated to outside counsel, increase the predictability of costs, ensure that outside counsel’s objectives correspond to the company’s objectives, and obtain better value of services from their outside counsel.

So, how are you, as in-house counsel to “Company-X,” going to achieve these goals and meet the demands of corporate leadership? You know that you must do something and that you must make changes, but what exactly should you do? What changes should you make? To help you with these difficult issues and decisions, we have assembled a roundtable of individuals to discuss possible solutions and ways to meet these goals. They will suggest that the consideration of alternative fee arrangements and the use of regional and midsize firms is a great starting point. Representing several perspectives on the question, our panel consists of two in-house attorneys, a consultant to both in-house and outside counsel, and one attorney with our firm.

Roundtable Participants:

Marla Persky is the General Counsel of Boehringer Ingelheim, the largest privately held pharmaceutical company in the world. Boehringer Ingelheim ranks fifteenth in revenues among the world’s leading pharmaceutical companies and has seen year-over-year growth far exceeding the pharmaceutical industry in general. Boehringer focuses on branded and generic prescription medicines, consumer healthcare, chemicals, biopharmaceuticals and animal health products.

Lisa Warren is an Assistant General Counsel of Johnson & Johnson. The Johnson & Johnson companies offer the world’s broadest range of healthcare products, ranging from face wash to orthopedic products as well as a wide array of medical devices to over-the-counter and prescription drugs.

Pam Woldow is a principal of Altman Weil Inc. Her international practice focuses on areas of strategic and operational importance to both legal departments and law firms, focusing on improving the delivery of high-quality and cost-effective legal services, selecting and managing outside counsel, convergence programs, litigation management, and all aspects of the counsel-client relationship. Altman Weil Inc. provides management consulting services exclusively to legal organizations.

Charles Johnson is a member of Butler Snow and is Co-Chair of the firm’s Pharmaceutical, Medical Device, and Healthcare Industry practice group. His practice consists primarily of the representation of pharmaceutical companies, medical device companies, physician practices, hospitals, and other healthcare providers in various types of transactional and compliance matters. When Marla Persky was with Baxter Healthcare, Butler Snow and Baxter established a fixed fee arrangement in which the firm “loaned” Charles to Baxter’s legal department to serve as interim-counsel to one of its subsidiaries.

Elizabeth Saxton: What actions, if any, has your legal department or law firm taken in the past to attempt to reduce costs and/or increase the value of services provided? Have these steps been successful?

Persky: Any in-house department has controllable and uncontrollable costs. Employees are a fixed cost. We control the fixed costs by holding headcount flat, ruthlessly prioritizing what we do and do not manage so as to focus our limited resources on the most strategic and value-added work for the organization. Outside counsel fees are often not controllable — we cannot prevent people from suing us. Therefore, in working with outside counsel, we have sought to obtain preferential billing rates through a convergence program that increases the volume of work we give a smaller number of firms. This concept has been successful to a point. We are reducing the number of firms with which we deal even further and looking for ways to better align risks with rewards so that our preferred provider firms share in the upsides of our business while standing beside us to endure the downsides as well. Alternative billing arrangements will become the norm for us, rather than the exception.

Warren: The primary areas of external legal expense are outside counsel and discovery fees and expenses. Our strategies to reduce these spend-centers focus on developing strategic partnerships with our key firms, implementing preferred pricing with our discovery vendors, and promoting proactive negotiations with both. In order to manage firm fees, our team has implemented a component-based alternative fee model that assigns unit costs to the bulk of pre-trial work on a matter-by-matter basis. We provide the firms an incentive to come in under budget, and a reconciliation process insures that the proposals are not artificially inflated to “game” the outcome. We also use an annual rate approval process, which allows us to negotiate rates and tiered discounting arrangements spanning all work completed by a firm in a calendar year.

Discovery projects can be very substantial for a given matter, and thus, each project involving fees in excess of $50,000 requires a Statement of Work (SOW). When possible, we issue competitive bidding events for the entire breadth of discovery services associated with the project to gain efficiencies of scale. The SOW gives visibility to costs up-front to verify that the scope and cost of the discovery project are warranted for favorable resolution of the matter and also implements an approval process to approve increases.

Johnson: We have offered many different cost-saving mechanisms to our clients in the past, some of which Marla and Lisa just alluded to. For example, we have entered into volume discount arrangements on an hourly rate basis, fixed fee, and flat fee arrangements in connection with transactions, corporate, and general contract work.

We have also entered into arrangements whereby we receive a flat fee per litigated matter for the first 120 days after the client tenders the matter to us. Our services under this flat fee include those services normally performed at the outset of litigation, and if we resolve a matter in the first 120 days of representation, then the client will pay us an early resolution bonus. Upon the termination of the initial 120 day period, the billing arrangement transitions to our ordinary hourly billing rates, but this preliminary flat rate provides clients with the ability to control costs and accurately budget during the early stages of a lawsuit. After this 120 day period, the client usually has a better understanding of its exposure in the particular lawsuit and can then assess the pluses and minuses of settlement. The early resolution bonus provides us with a reward for reaching a speedy resolution and at the same time still provides the client with a great cost-savings in the long run.

Saxton: What have been the primary impediments, if any, that you have seen or experienced when trying to implement new legal billing methods and concepts? Have you been able to overcome these impediments, and if so, how?

Warren: We use electronic billing to track our alternative fees. The UTBMS codes used for e-billing are a close-fit but do not match our version of the pre-trial work breakdown structure. After mapping the codes to our template, we were able to use the current UTBMS code set. However, we invested significant effort to redefine the codes to match the components we innumerate in our alternative fee template.

Persky: I hear the “it won’t work” excuse — litigation isn’t controllable; we don’t know how difficult the negotiation will be with the other side; who knows how extensive the government investigation will become. I simply don’t buy these arguments. Any business person will tell you that they manage to a budget despite the fact that business is rife with unknowns — that is why you list upside and downside potentials. We are insisting on budgets for all matters — this requirement helps drive billing arrangements towards fixed fees, flat fees, and retainer agreements for certain matters and categories of work. I am still pushing the greater use of contingency fees and modified contingency relationships. At the end of the day, the law firms that trust us as their business partner and are willing to explore new ways to handle their billing structure will become our long-term partners. There are a lot of firms out there and thousands of good lawyers — one way to differentiate a law firm from the masses is creativity and fairness.

Johnson: When we first began implementing new billing methods, many members of the firm were concerned that these arrangements would not work, and many of the excuses that Marla just mentioned were used to try to stall the implementation process. However, once we took the plunge and began using them, both the firm and our clients have been pleased with the results.

Saxton: Pam, what alternative fee arrangements are you seeing law firms and corporate legal departments use and for what type of work are they using these alternative fee arrangements?

Woldow: The term “alternative fee” is sometimes used rather loosely to refer to any fee arrangement other than a firm’s standard hourly rate. Alternative fees are generally defined as fees that are not based in any way on hourly billing. So, discounted hourly rates and blended hourly rates are not alternative fees because they are still based on the billable hour.

What alternative fee arrangements (AFAs) accomplish are: 1) predictability of cost; 2) budgeting and planning certainty; 3) billing that reflects an assessment of the value of a matter; and 4) more efficient lawyering.

There are many creative billing solutions, but I’m seeing three types most often. These are good places to start if an organization has not used AFAs before.

Fixed fees are set fees for a group of matters or tasks for a fixed period of time. For example, Pfizer pays a fixed fee to a law firm to handle all of its employment matters nationwide. No billable hours, no per-matter fees; just one sum paid out monthly over the course of the year. Cisco is now in the third year of paying a fixed fee to one firm for all its U.S. litigation. And, Goodyear is in the process of selecting a firm to handle its U.S. products liability disputes on a fixed fee basis. Fixed fees are useful when the organization knows it will have a relatively predictable and steady number of matters year over year or else defines the number of matters that will be covered by the fixed fee.

Flat fees are set fees for given types of tasks or matters. For example, an organization might pay $2,500 for arbitrating a warranty claim. Whether there are 10 or 10,000, the cost will be based on a per matter basis, and the company will know exactly how much each matter will cost when it arises. Flat fees are often used for discrete or finite matters or tasks, such as filing a complaint. They work well where the organization is not able to predict the number of matters it will face.

Contingency fees are used most typically in the form of a base fee plus a success fee determined by the outcome of the matter. In the defense setting, this arrangement requires the lawyer and the client to assess the potential legal exposure as part of the initial case planning. They determine a specific dollar amount that would represent a satisfactory result. If the lawyer resolves the matter for less than that number, the lawyer profits by sharing in the savings. FMC uses this AFA for its mass tort matters. Holdbacks are a variation of this approach, where the legal department defers payment of some portion of the fee until the matter is resolved and the results are known. The St. Joe Company and CSX Corporation use the holdback method and, depending on the performance of the law firm, will pay the holdback or a multiplier of it depending on whether the law firm met certain performance standards.

Saxton: Moving into 2009, it is apparent that changes must be made in terms of how corporate legal departments receive and pay for legal services. Please discuss some alternative fee arrangements that you believe provide for the greatest possibilities for reduced costs and increased predictability.

Warren: Negotiating costs at a unit level allows for greater granularity when formulating budgets. The ability to control and monitor these costs requires time-relevant data and analysis resources. In-house decision makers are more empowered to adjust detailed assumptions rather than conglomerated amounts, which may be inflated to protect against overspending.

Persky: As Pam just mentioned, I think that fixed fees and flat fees are the easiest to implement. They guarantee a cash flow to the law firm and give the client cost predictability. Contingency fees are a way to assure that the risk-reward ratio between a law firm and a client is in sync. The key to effectively using contingency fees in the corporate setting, however, is to clearly define the meaning of a “win.” It strikes me as odd that while clients are downsizing, revising earnings estimates, and looking for ways to reduce costs, law firms are increasing their hourly rates. This approach is not a sustainable business model for law firms.

Saxton: In addition to alternative fee arrangements, what other suggestions and solutions do you have for corporate legal departments that are attempting to reduce costs?

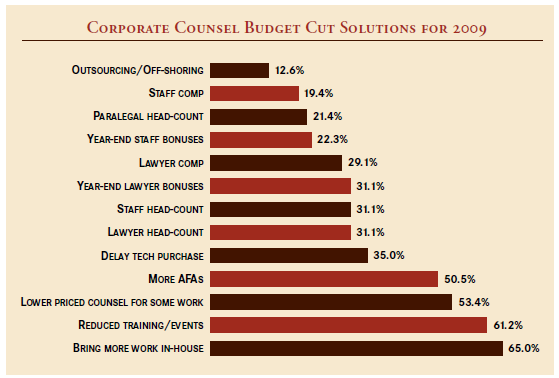

Woldow: Altman Weil recently conducted a Flash Survey of in-house corporate counsel in November 2008 to determine how they were addressing legal department budget changes for 2009. From corporations of all sizes and industries, we learned that 75% of corporate legal departments will have their budgets cut in 2009. We then asked: If you are facing a budget cut, or a smaller increase, where/how will you make reductions? Corporate counsel rated their intended solutions as follows:

One of the top three cost-savers identified was to engage lower-priced counsel. Increasingly, we are seeing companies consider small or mid-size regional firms for many important matters. Altman Weil’s clients tell us that they can achieve a 20 percent saving just by moving matters to appropriate regional firms with demonstrated expertise but lower rates. If they then negotiate alternative fees, they achieve even greater savings.

Offshoring legal services has moved into the mainstream and is another way to achieve cost savings. Although so far it has not been widely used, we see that changing. In August of 2008, the ABA issued a significant ethics opinion ratifying the use of offshore resources for legal services.7 The Wall Street Journal reported recently that offshoring legal work is a major and growing solution to controlling legal costs.8 Some companies are using these services directly, such as Sun Microsystems, for a variety of legal services such as legal research, due diligence, patent prosecution, patent illustration, discovery document review, and contract review. We also see companies calling on their law firms to unbundle certain tasks and send them offshore rather than paying U.S. associate rates for the work. Many companies have a greater comfort level using U.S. trained and U.S. based attorneys and find that they can achieve similar cost savings by moving large blocks of matters to regional firms. There can be challenges to off-shoring work, such as the time differences, the need to assure confidentiality, and the markedly different way in which work is accomplished.

Finally, if a legal department has not already done so, it can undertake a “convergence” program to reduce the number of outside firms it uses and leverage its outside spending by concentrating it in fewer firms. Convergences is a well-proven cost-saver: It costs more to manage many firms, both in terms of internal resources and time, and a smaller cohort of preferred providers allows better control and greater bargaining leverage as well.

Warren: Our outside attorneys are hired for their legal talents and their skills in favorably managing and resolving matters, not for their fiscal acumen. For clients who are struggling with a strategy, the first management step may be to dedicate all or part of a resource with experience in negotiating discounts/rate increases, managing discovery scope, financially analyzing RFPs, and building a metrics architecture for monitoring ongoing costs. We have found that to be an invaluable tool in architecting cost reduction strategies.

Implement a rate change request process. Many firms increase rates without notification resulting in spend which could be avoided through an up-front negotiation. Having a negotiation insures that the firm will not try to implement unfairly high rates because they will likely police themselves as a result of the client’s scrutiny.

Saxton: Is it possible to intertwine these different solutions, or is it best to implement just one solution at a time?

Woldow: As corporate counsel become more comfortable with AFAs, they can and do craft them to meet their specific needs. We have seen numerous variations and combinations. For example, if a company is just starting to use AFAs, it is advisable to try them in lower risk matters and use one of the three principal approaches I mentioned earlier. The effective use of AFAs is predicated on the level of historical information a department has on its legal spending, for example, what types of matters, geographical span. The more detailed that information, the better the department will be able to know how much it has spent previously on specific types of matters. Armed with this historical perspective, it can negotiate fees that maintain or reduce previous spending. But lack of every data bit should not prevent a department from using this powerful tool. We have seen departments who maintained information in paper spreadsheets achieve major savings.

Warren: Parallel path cost reduction experiments using different strategies such as capped fees or alternative fees are fine. However, because not much can be done without a matter management and e-billing infrastructure, this implementation should be first priority.

Persky: I believe that a controlled, measurable, multifaceted approach will net the greatest returns in the shortest period of time.

Johnson: We have implemented more than one alternative fee arrangement at once with certain clients, depending on the types of matters for which they seek our counsel, and in all cases this multi-faceted approach has been successful. In addition to the interest in various AFA, we have also seen a trend toward hiring mid-size and regional firms in order to achieve even greater savings.

Saxton: Because alternative fee arrangements and other cost-cutting solutions can be a bit intimidating and difficult to grasp for those who have never used them, please discuss potential safeguards in alternative fee arrangements.

Woldow: When using AFAs, it is important to work with a law firm with which you enjoy a trusting relationship and/or has used AFAs successfully with other clients. AFAs may require some tweaks or adjustments to achieve the most workable solution, and it helps to have both parties invested in preserving a positive relationship. For both parties, it helps to define parameters for the engagement, for example, number of anticipated matters, time frame, and dollar amount ranges involved in disputes. If the parameters are exceeded or not met, the parties can have a productive discussion about adjusting the fee. The parameters also might carve out unusual events that would remove the matter from the AFA.

We recommend that the parties establish “look back windows”— set times for assessing how the arrangement is working — always understanding that they can open that discussion sooner if there is a need. Sometimes, it behooves the parties to let six months to a year elapse to allow sufficient time for the entire book of business to develop. For example, in the first year of Cisco’s fixed fee arrangement for litigation, new matters were slow to be filed and Cisco began to worry that it was paying too much. However, by the end of the third quarter, the filings had reached the anticipated point, and its outside firm was handling exactly what the arrangement covered. Both parties have been very pleased.

In addition, it can help to build in “collars.” A collar is an understanding between the legal department and the law firm that if actual costs exceed a certain amount or percentage or fall short by that same amount, then the parties agree to make a correction. For example, if the number of matters covered by the AFA is 10% more than the defined parameter, the firm would be entitled to additional payment. Conversely, if there are 10% fewer matters, the legal department is due a refund or credit.

Johnson: I agree that the key to making AFAs work for both the client and the law firm lies in a strong working relationship between the two parties — they must work together as a team and be willing to look back and evaluate the situation in order to determine if the arrangement is beneficial to both parties. We have entered into risk sharing and adjustment mechanisms similar to those that Pam just discussed, and our clients have responded well as these arrangements allow us and the client to share both the risk and the reward of budgeting and performing the work efficiently.

Warren: Training: We partner with our procurement resources to train our outside counsel on our alternative fee management process. This training can be anything from a one-on-one phone call to a WebEx. Along with our alternative fee template, we distribute a quick reference sheet to our outside counsel, which outlines our reconciliation process.

Stage Gate Reviews: Outside and in-house counsels meet after the resolution of major events, namely early case assessment, filing of pleadings, filing and argument of dispositive motions, and substantive discovery. These meetings act as stage gate reviews to determine if spending is tracking in step with the alternative fee. Many progressive firms have taken the onus on themselves to provide customized spend and projection reports for review during these meetings. In all other cases, our procurement resources are able to pull real time billing data at any point during the matter to match actuals with budget. This provides the firm a progress report and highlights any critical areas that need review to ensure the budgetary commitments accurately reflect the work needed on the case.

Capping Liability: Many alternative fee arrangements for long-range matters involve a large peak of work that eventually settles into a monthly repetitive set of tasks. Where warranted, we cap fees for the firm to a monthly or quarterly amount. This method provides predictability to the business in terms of budgeting, and firms have the flexibility to allocate funds as necessary to get the base work complete. Any unforeseen work reverts to pre-negotiated billable rates.

Persky: The goal is cost savings and predictability. It is not putting the outside counsel out of business. For a partnership to work, it needs to work for both parties. The ability to make midterm adjustments to alternative fee arrangements when the truly unexpected occurs is a good “safety net.”

Because of space limitations, we recognize that

we have not addressed all alternative fee arrangements and cost-saving

mechanisms available. We understand the evolving nature and importance of this

topic and do expect, if appropriate and useful, to produce subsequent articles

on the subject. Thus, we welcome our readers to submit questions to us or tell

us about the mechanisms they have implemented and found useful, helpful,

successful, or unsuccessful, and we will share this information anonymously

with our other readers if the submitting reader so desires. The billable hour

may not be dead, but alternative billing arrangements are definitely going to

continue to receive much attention in the year to come.

[1] Stanton, Elizabeth, “U.S. Stocks Post Biggest Post-Election Drop on Economic Concern,” November 5, 2008, available at <http://www.bloomberg.com/apps/news?pid=newsarchive&sid=ahxDxARQcLBc>.

[2] Id.

[3] Hill, Catey, New York Daily News, “ADP National Employment Report: Private Sector Loses 250,000 Jobs, Outlook Worse Than Expected,” December 3, 2008, available at <http://www.nydailynews.com/money/2008/12/03/2008-12-03_adp_national_employment_report_private_s.html>.

[4] See Stanton, supra note 1.

[5] The “Altman Weil Flash Survey on Law Department Cost Control,” conducted in November 2008, reports that 75% of law departments surveyed are facing budget cuts averaging 11.5% for 2009. The full survey is available at <http://www.altmanweil.com/index.cfm/fa/r.resource_detail/oid/d664b2c6-9978-4327-a66e-757972ebd091/resource/Altman_Weil_Flash_Survey_Law_Department_Cost_Control.cfm>.

[6] Jones, Leigh, The National Law Journal, “Law Firm Fees Defy Gravity, Annual Survey Shows,” December 8, 2008, available at <http://www.law.com/jsp/article.jsp?id =1202426547201&rss=newswire>.

[7] ABA Comm. on Ethics and Prof’l Responsibility, Formal Opinion 08-451 (Aug. 5, 2008).

[8] See Sheth, Nirah and Nathan Koppel, “When Times Get Tight, Even Lawyers Get Outsourced,” Wall Street Journal, November 26, 2008, available at <http://online.wsj.com/article/SB122765161306957779.html>.

Finis

Citations

- Stanton, Elizabeth, “U.S. Stocks Post Biggest Post-Election Drop on Economic Concern,” November 5, 2008, available at <http://www.bloomberg.com/apps/news?pid=newsarchive&sid=ahxDxARQcLBc>. Jump back to footnote 1 in the text

- Id. Jump back to footnote 2 in the text

- Hill, Catey, New York Daily News, “ADP National Employment Report: Private Sector Loses 250,000 Jobs, Outlook Worse Than Expected,” December 3, 2008, available at <http://www.nydailynews.com/money/2008/12/03/2008-12-03_adp_national_employment_report_private_s.html>. Jump back to footnote 3 in the text

- See Stanton, supra note 1. Jump back to footnote 4 in the text

- The “Altman Weil Flash Survey on Law Department Cost Control,” conducted in November 2008, reports that 75% of law departments surveyed are facing budget cuts averaging 11.5% for 2009. The full survey is available at <http://www.altmanweil.com/index.cfm/fa/r.resource_detail/oid/d664b2c6-9978-4327-a66e-757972ebd091/resource/Altman_Weil_Flash_Survey_Law_Department_Cost_Control.cfm>. Jump back to footnote 5 in the text

- Jones, Leigh, The National Law Journal, “Law Firm Fees Defy Gravity, Annual Survey Shows,” December 8, 2008, available at <http://www.law.com/jsp/article.jsp?id =1202426547201&rss=newswire>. Jump back to footnote 6 in the text

- ABA Comm. on Ethics and Prof’l Responsibility, Formal Opinion 08-451 (Aug. 5, 2008). Jump back to footnote 7 in the text

- See Sheth, Nirah and Nathan Koppel, “When Times Get Tight, Even Lawyers Get Outsourced,” Wall Street Journal, November 26, 2008, available at <http://online.wsj.com/article/SB122765161306957779.html>. Jump back to footnote 8 in the text